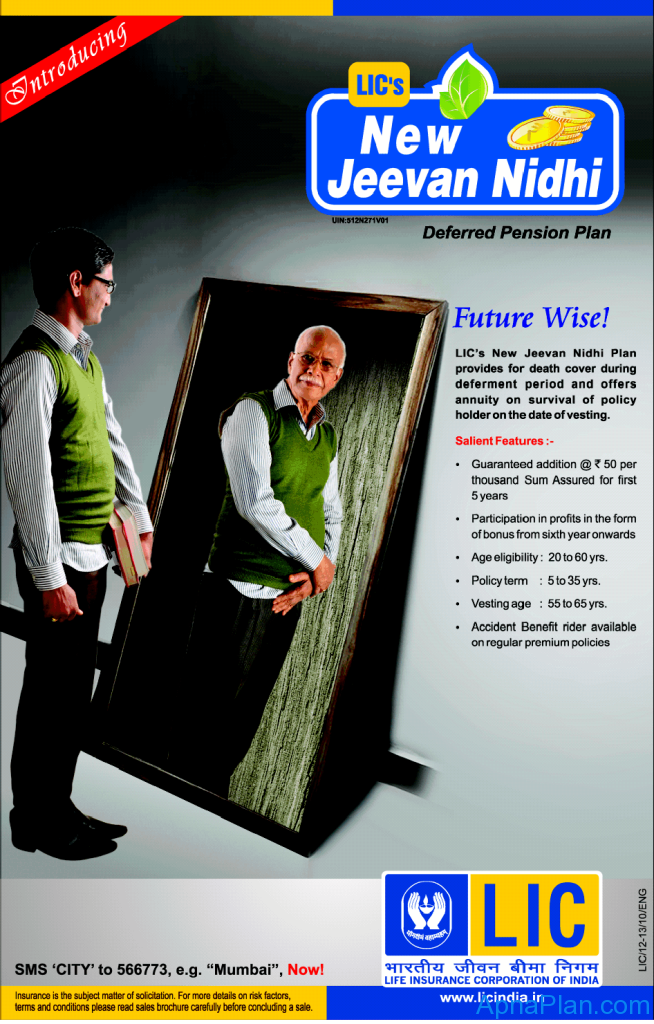

LIC's New Jeevan Nidhi

LIC's New Jeevan Nidhi Plan is a conventional with profits pension plan which provides for death cover during the deferment period and offers annuity on survival to the date of vesting.

Benefits

Death During five Years of Policy -in case of death during five years ,nominee will get Sum Assured plus Guaranteed addition.

Death During after five Years of Policy -in case of death after five years ,Basic Sum Assured+ Guaranteed Addition +Simple Reversionary Bonus and Final Additional Bonus will Provide to Nominee.

Vesting Benefit - You have three options at the time of vesting you can Withdraw one third amount & purchase annuity of resting amount you can purchase annuity for all amount or you can Buy a Single Premium Deferred Annuity Plan

Rider Benefits There are two Rider Benefits with this Policy

- LIC Accidental Death Rider

- Disability Benefit Rider

Guaranteed Additions - New Jeevan Nidhi Provide Guaranteed Additions at 50rs. Per thousand in Five Years.

Partipations in Profits - New Jeevan Nidhi Participate in Corporation Profits from 6th year Onwards.

Income Tax Benefit - Income Tax Benefits available on Paid Life Insurance Premium under Section 80C & 1/3rd of Maturity Benefit will also be tax free under section 10(10A)but Pension will be taxable.

Eligibility for LIC New Jeevan Nidhi Plan

- Age : Minimum Age will be 20 Years ,maximum entry age will be 60 years(in case of single premium) and 58 years in case of Regular Premium.

- Policy Term: 5 to 35 years (in case of Single Premium) or 7 to 35 years (in regular Premium).

- Minimum Vesting Age : 55 years

- Maximum Vesting Age : 65 years.

- Minimum Sum Assured : 1,00,000 in case of Regular Policy and 1,50,000 in case of Single Premium Policies.

Premium Mode in LIC New Jeevan Nidhi - Premium mode will be Monthly, Quarterly, Half- yearly and Yearly.